6 Types of Taxes Every H1-B Visa Holder Pays in the US

For an Indian, an H1-B visa is a passport to their great American dream! You gain money, respect, and an international experience on your résumé. You do, however, earn in dollars and pay taxes in dollars.

If you’re unfamiliar with the H1-B holder tax filing process, we’ve put together a step-by-step guide to help you get it right.

Recommended: Tax Filing for Indian H1B Visa Holders: All You Need to Know – AOTAX.COM

What is an H1-B Visa?

An H1B visa is granted to Indians (as a nonimmigrant classification) who work in specialized fields such as medicine, science, mathematics, accounting, and information technology (IT) firms or spaces in the United States.

Furthermore, your American employer who sponsors you covers your three-year stay in the United States under this visa. This means they pay for your visa fees and fill out the form on your behalf.

Substantial Presence Test (SPT)

Passing the SPT is essential for becoming a tax resident in the United States. You must have spent at least 183 days in the United States over the previous three years to pass this test. Under the SPT, even the days for each year are subdivided further.

You should have spent 31 days in the United States during the year in which you do your H1-B visa holder tax return. Then it’s 1/3 of days for the previous year and 1/6 of days for the earlier two years. So the total number of days in the three years should be at least 183.

6 Types of Taxes you Pay During H1-B Holder Tax Filing

According to the US tax code, when you qualify for the SPT for H1B holder tax filing, around 25% to 35% of your income will be taxed. Therefore, you will pay the same taxes as any other US tax resident, but you may not receive the same benefits.

However, the following taxes you will pay during the H1-B holder tax filing:

1) Social Security

Contributing to social security is similar to putting money down for a rainy day fund that will pay off in your golden years. In addition, it will assist you in obtaining a pension when you retire. As a rule, you must contribute 6.2% of your gross salary to this account. In addition, your company will make a matching contribution to the social security fund.

2) Medicare

This tax, like your pension, covers medical expenditures after you retire. Medicare costs 1.45 % of your gross wage, and your employer contributes an equal amount.

Whether or not you stay in the United States after retirement has no bearing on your Medicare and Social Security taxes payment.

3) Federal income tax

As an H1-B visa holder, you will pay a federal income tax of 25% to 28% on your taxable income. It is determined by your annual income and your filing status (married or single).

Furthermore, you will be taxed the same as a US resident if you file as a non-resident foreigner, but you may not be eligible for the same tax incentives.

However, if you choose to file as a resident, you will receive some tax benefits. As a result, assess the benefits and drawbacks before proceeding with H1B holder tax filing.

4) State income tax

The state of residence in the United States has a significant influence in determining whether or not you are tax liable. In California, for example, state taxes range from 6.5 % to 10% of one’s gross income.

While Alaska, Florida, Nevada, Wyoming, Washington, and South Dakota do not have a separate income tax for non-residents. In addition, you will be taxed on the interest and dividends you earn in the United States in states like Tennessee and New Hampshire.

5) Local taxes

Indian H1B visa holders must pay local taxes of 4% of their gross income. This tax depends on where you stay in the United States. Some towns and cities incur local income taxes.

Please note, though, that in most cases, your local taxes will be covered in your paycheck by your employer as long as you’ve updated the address in your W4 form. However, if you accidentally put the wrong address in the W4 form, you may pay the wrong local taxes.

6) Obamacare

Under Obamacare, your US company will cover the cost of your healthcare. For now, this is a compulsory tax you, as an Indian H1-B visa holder, will be paying; however, this might change.

H1-B holder tax filing: Documents required

It’s critical to get your papers before initiating the H1B holder tax filing procedure. Keep the following documents ready:

1) Social security number

2) W-2 tax form

3) A photo identification card

4) Other sources of investment income

5) Form 1040 NR if you have dependents

6) Receipts that can be used to claim tax deductions

7) If you or your spouse relocated due to your marriage, fill out Form 8852.

8) If you changed your name after marriage, you’ll need to fill out Form SS-5.

9) Complete Form W 4 to report a change in income after marriage.

Recommended: How to File US Taxes as an Indian H1-B Visa Holder? – AOTAX.COM

H1B Income Tax Savers

It’s time to look for ways to save money on taxes when you go for H1B holder tax filing. Following is the list of deductions and tax credits to help you save dollars.

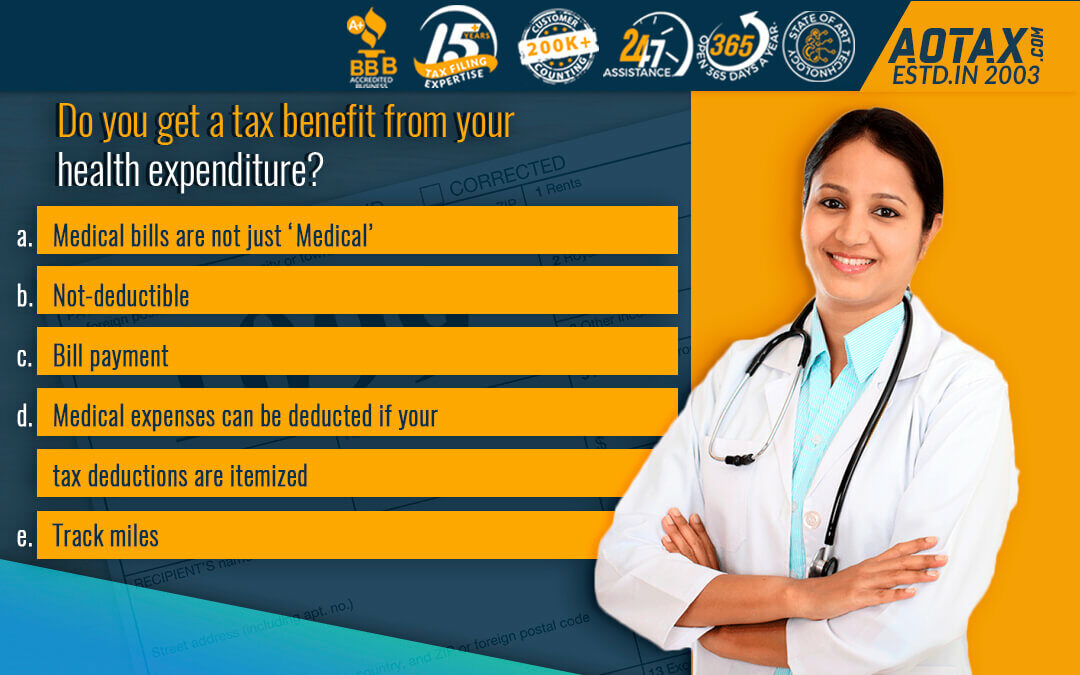

1) Tax deductions: When you choose to pay taxes as a resident of the United States, you can deduct expenses such as your mortgage, health care, and dental care. Please submit the necessary receipts to claim them.

2) Investments: If you’ve made stock market, fixed deposit, or retirement plan investments, you’ll be able to claim tax deductions.

3) Medical deduction: File Form 1040 with Schedule A to claim the medical deduction. If your medical costs were more than 7.5 percent of your adjusted gross income, you may be eligible for this benefit.

4) Charitable donations: Giving to social causes and charities can help you save money on taxes.

5) Moving expenditures: You can claim a tax deduction on your moving expenses if you relocate from India to the United States or any other state in the United States.

6) Dependents: You can claim your family as dependents and deduct your taxable income except for your spouse. They will, however, be obligated to file taxes, either jointly or separately, with you.

7) Medicare on OPT: If you are on OPT (optical training test) and have an H1B visa, you can claim the Medicare amount withheld by your employer.

The H1B holder tax filing is not as complicated as you think. If you follow the above steps, it’s possible to file your taxes on time and be in the good books of the IRS (Internal Revenue Service).In case you are an Indian who is new to H1B visa holder tax filing, you can connect with AOTAX for guidance. Our team of tax planners and advisors will help you pay your taxes on time and save some serious dollars in the process. Thanks to the 25-years of being in your service, we know our work!

Recent Comments