All you need to know about State-specific Tax deadlines and COVID-19

All you need to know about State-specific Tax deadlines and COVID-19

The pandemic COVID-19 has affected the economic lives of the Americans in a very adverse manner. The Federal Government and the State Government have taken initiatives to reduce the stress of the Americans by bringing up numerous changes in the tax laws.

The Federal Government has extended the deadline for filing tax returns and also payment of taxes to 15th July 2020. There are some states which have aligned to the changes in the Federal tax laws and have extended their deadlines as well. However, there are some other states which are still charging interest on the non-payment of taxes on time.

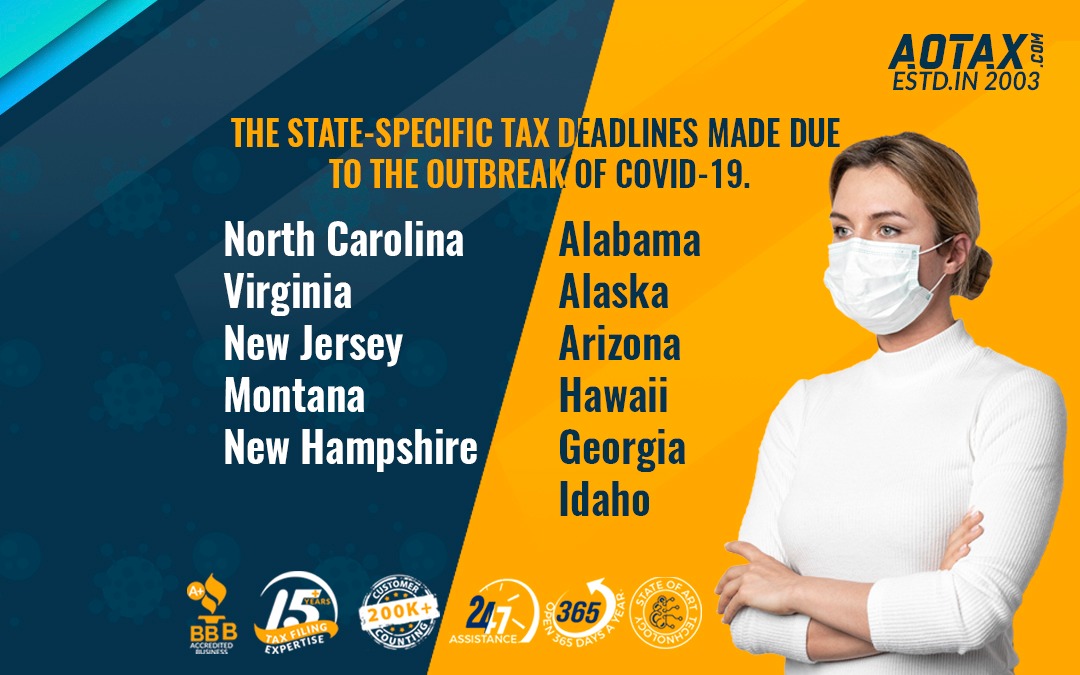

Let us know about the changes in some of the State-specific tax deadlines made due to the outbreak of COVID-19.

a.Alabama

1.Alabama has postponed the tax returns filing and payment date from 15th April 2020 to 15th July 2020 for the below-mentioned categories of taxes.

- Individual Income Tax

- Excise Tax for financial institutions

- Corporate Income Tax

- Business privilege Tax

2.These tax reforms include relief on the payment of tax on self-employment income and the estimated income tax for the year 2020.

3.Penalties for the late payment of Sales and Use tax have been waived for small businesses.

b.Alaska

- The Alaska Legislation has extended all tax returns and payments administered by the Alaska Revenue Tax Division due for 15th April 2020 until 15th July 2020.

- No penalties or interest would be charged for the late payment of the taxes during this period.

c.Arizona

- In Arizona, the deadline for the filing of tax returns and payment of State Income Tax due on 15th April 2020 has been extended to 15th July 2020.

- This extension in the deadline is applicable for individuals, corporations, and fiduciaries.

d.Hawaii

- In Hawaii, the taxpayers who are due to file their State Income Tax returns or pay the State taxes from 20th April 2020 to 20th June 2020 can do that by 20th July 2020.

- This extension is applicable only for the Hawaii income tax return filing and payment; and not applicable for estimated income tax payment, franchise tax, withholding tax, general excise tax or public service company tax.

e.Georgia

- The Governor of Georgia has announced that there would be an extension in the deadline for filing of Georgia’s income tax returns.

- The new deadline has been determined as 15th July 2020 which is per that of the federal deadline.

f.Idaho

- The deadline for filing Idaho’s Income Tax returns has been extended till 15th June 2020.

- In this case, it is advisable to complete both Federal and State tax return filing by 15th June 2020 so that the returns can also be obtained on time.

g.North Carolina

- In North Carolina, the deadline for filing state tax return has been extended to 15th July 2020.

- But, interest would be charged on any tax payment which is made after 15th April 2020. So, taxpayers should pay their tax soon to avoid being charged with interest.

h.Virginia

- The Virginian State Government has extended the State Income Tax return filing date to 1st May 2020.

- However, interest would be levied on any late payment of State Income Tax which is due within 1st April to 1st June 2020. It is advisable to file the returns and even pay the taxes soon.

i.New Jersey

- In New Jersey, the timeline to file and pay the individual gross income tax, corporation business tax, and partnership tax for the year 2019 has been extended until 15th July 2020.

- This extension of the deadline is also applicable for the 1st quarter estimated tax payments.

However, all other payments of tax and filing of returns remain de on their original date which also includes the 2nd quarter estimated tax payments.

j.New Hampshire

- According to the New Hampshire Department of Revenue Administration, there would be no changes in the deadlines for payment and returns of business profits tax, business enterprise tax or any other tax which is administered by the Department.

- The interests on non-payment of taxes would be charged from 15th April 2020 onwards.

k.Montana

- Montana has made an extension in the deadline for the filing of tax returns and for the payment of individual State income tax to 15th July 2020.

- There has also been an extension in the deadline for making the payment of the 1st quarter estimated tax payments to 15th July 2020.

Hence, these are some of the States which have made certain changes in their tax laws for bringing some relief to the Americans. However, for detailed information on the State tax law changes the State tax Consultant must be consulted.

References

- https://blog.turbotax.intuit.com/tax-news/what-is-my-state-tax-deadline-what-to-know-about-coronavirus-and-state-specific-tax-deadlines-46778/

- https://www.plantemoran.com/explore-our-thinking/insight/2020/03/covid19-march-27-state-and-local-tax-updates#New%20York

- https://pro.bloombergtax.com/covid-19-state-tax-impacts/

Recent Comments