All You Need to Know on How to Fill Out Form 8962 Step-By-Step in 2022

Taxpayers should file IRS Form 8962 with their federal income tax return to claim the Premium Tax Credit (PTC). The PTC is intended to assist taxpayers in recouping some of the costs of health insurance purchased through the health insurance marketplace.

Taxpayers reconcile the tax credit they are entitled to with any advance credit payments for the tax year using Form 8962. In addition, to qualify for the PTC, taxpayers or their family members should have been enrolled in a health insurance program through the marketplace for a minimum of one month during the tax year.

The cost of available health insurance, the size of the taxpayer’s family, where the taxpayer lives, and the address determine the tax credit amount. Hence, if you receive healthcare from your employer (1095-C form), you will not file Form 8962. Also, if you have health insurance through another company and have received a 1095-B form confirming your coverage, you cannot use Form 8962.

Given all the terms and conditions regarding the Form, it could get challenging to fill the same. If you’re wondering how to fill out Form 8962, then you’re on the right page.

What Is Advance Premium Tax Credit

The advanced premium tax credit is a federal tax credit for individuals that reduces the monthly health insurance premiums they must pay when purchasing coverage through the Marketplace.

When you sign up for a qualified health plan on the health insurance marketplace, the system determines whether you are eligible for a subsidy. The marketplace determines your eligibility for a subsidy based on your income and personal exemptions, known as an advance payment or APTC.

You should report any changes in your income or personal exemptions to the marketplace if they occur throughout the year. If you do not, you might receive too much or too little in APTC.

On the other hand, if your income increases and you do not declare it, the government may pay you or your insurer too much APTC. In such a case, you use Form 8962 to reconcile your PTC eligibility with the APTC already paid.

If you are qualified for more PTC than you were paid in APTC, you may be able to get the difference you paid back in your tax return.

For 2021 and 2022, the American Rescue Plan Act of 2021 eliminates the advanced premium tax credit income cap. Instead, on the high end, the act caps premiums at 8.5% of the payer’s modified adjusted gross income (i.e., for people with adjusted gross income above 400% of the poverty level).

The “net Premium Tax Credits” are also claimed using Form 8962. These are for qualified persons who, instead of receiving an APTC, choose to pay their insurance premiums out of pocket throughout the year and then claim the PTC at the end of the year.

Points to Consider Before Filling Out Form 8962

These are some things you should consider before starting the filing procedure. This checklist will help you keep track of the validity and authenticity of your filing process:

- Either you or a member of your family must be enrolled in a health plan covered by the “Market Plan”.

- As a recipient, you are lawfully residing in the US. This is to establish residency.

- To complete the filing of Form 8962, an extra Form 1095-A is necessary.

- The marketplace sends this, and if you haven’t received it by early February, you have to contact them.

- The PTC estimate provided by the Marketplace is likely to decide your Advance PTC eligibility.

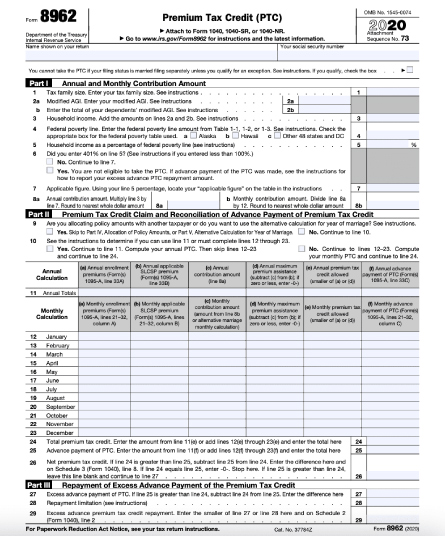

Reading Form 8962

Form 8962 is a two-page document with five sections:

- Part I is where you enter the annual and monthly payment amounts based on the size of your family, modified adjusted gross income, and household income.

- Part II is where you balance the amount of your advanced premium tax credit with the amount of your monthly premiums.

- Based on the information you supplied in Part II, Part III is utilized to determine any excess advance premium tax credit payments.

- Part IV permits you to assign policy funds, whereas Part V is utilized for alternative calculation of your year of marriage.

- To complete each component of the form, you’ll need Form 1095-A, as well as your Form 1040, which shows your modified adjusted gross income.

- If the information on your Form 1095-A is incorrect, you must update it before filling out Form 8962. Contact the Health Insurance Marketplace to receive an updated form.

Download the Premium Tax Credit (Form 8962)

The IRS website has Form 8962, which is free to download. When you move through the program’s questionnaire format, this form should be generated for you if you’re filing taxes electronically.

Instructions for IRS Form 8962: A Complete Guide

If you’re unsure how to fill out Form 8962, follow the steps below to learn everything you need to know:

Step 1

First, you’ll need to obtain IRS Form 8962. You can get it from:

- The Treasury Department

- IRS website

Step 2

- You will receive a PDF file of the form. Now, you will begin the filing procedure.

- Fill in your name as it appears on your tax return and your Social Security number at the top of the form.

Step 3

Next, go to “Part 1” of the form. Begin by filling in the exemptions from Form 1040-A on the first line. Next, you should enter the amounts relating to the updated AGI on lines 2A and 2B. Next, you must add the Household Income to line 3; to do so, simply add the numbers from lines 2A and 2B. To complete line 4, simply select the appropriate option and enter the proper value. Finally, add the household income in terms of the percentage of the Poverty Line on line 5. Skip to line 7 if your value is more significant than 401%.

Step 4

In Line 7, enter the needed figure, and then in Line 8, enter the annual contribution amount.

Step 5

Now, we’ll go to Part 2 of IRS Form 8962. The name of this section is: “Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit.” Proceed to Line 11 after selecting the proper options on Lines 9 and 10. There’s a little table to fill up the monthly amounts column-by-column. You’ll fill up the lines 12-23 due to this. Line 24 (Total PTC) is below the table and is where you must add the Total PTC. Then comes Line 25, where you must enter the Advance payment.

Step 6

We shall not continue to Part 3 of the application. This section is known as “Repayment of Excess Advance Payment of the Premium Tax Credit.” So instead, we’ll go on to Line 27, where you’ll need to fill in the ‘Advance Premium Tax Credit.’

Step 7

This section is known as “Shared Policy Allocation.” Lines 30-33 make up this section. You must fill in the values in the table that is provided, which includes:

- The policy number is entered in the field a.

- SSN field (field b).

- In Field c, enter the allotment for the first month.

- Fill in the allotment ending the month in Field d.

- The premium % should be entered in field e.

- In field f, enter the SLCSP percentage.

- In field g, enter the advance payment for the PTC percentage.

Step 8

This section is the “Alternative Calculation for the Year of Marriage”. Add the alternate entries for your Social Security Number in fields a, b, c, and d when you get to line 35. Then, add the alternate entries for your spouse’s SSN on fields a, b, c, and d when you get to line 36.

Final Thoughts

Whether you receive an Advance PTC or claim a PTC at year’s end, you must file Form 8962 with your tax return if you purchase health insurance through the Marketplace and qualify for Premium Tax Credits (PTC). In addition, your local health exchange should send you a Health Insurance Marketplace Statement (Form 1095-A) to assist you in filling it out.

Are you wondering how to fill out Form 8962? AOTAX makes preparing and filing your taxes quick, easy, and affordable so that you get your maximum refund.

We are Registered Tax Agents with vast hands-on expertise, and we take great pride in assisting our clients in achieving their objectives. Thanks to a team of highly skilled and experienced Tax Accountants, we do everything we can to reduce your tax liability while making the overall taxation process as efficient, simple, and cost-effective as possible. Contact us if you are an IT professional working in the USA and looking at filing tax in the USA.

Recent Comments