What Is W-9 Form and How to Fill It Correctly?

With the tax season in full swing, people are scrambling to file their tax returns by April 18th in the US. If you are reading this, then the chances are that you, too, are looking to do your taxes, specifically your W-9. For instance, if you’re an Indian residing in the US as a resident alien for tax purposes, you’re liable to file your income taxes, even if you’re a freelancer. This piece aims to dissect the W-9 form to its core to help you understand how to fill out W-9 for individuals.

Are you busy? Or missed the deadline? Fret not, check out this article on how to file for a tax extension.

What Is a W-9 Form?

The W-9 is an official request form for the taxpayer’s Taxpayer Identification Number (TIN) and certification by the employer. The W-9 also records personally-identifying information such as your name, address, and account numbers.

Essentially, the form functions as a contract that you, as a contractor or freelancer, take responsibility for withholding taxes from your income generated with the business.

While a full-time employee doesn’t need to worry about this form as their employer deducts income and FICA taxes right out of their paycheck, it isn’t the case with freelancers.

Tax forms are vital to you and the government; check out this article to avoid making mistakes on your tax forms.

The W-9 Form is for Whom?

You must fill out the W9 form with your employer if you have made over $600 in that financial year without being hired as a full-time employee.

When you begin working for a business as a freelancer or contractor, you will be issued a W-9 form by the enterprise to report your earnings.

While you still need to record your income directly to the IRS, the W-9 form serves as a secondary reporting source done through the business that employs you.

Unlike the W-4 form, W-9 is intended solely for contract workers, freelancers, and self-employed individuals working in the US.

Your employer exclusively uses the details you fill out on your W-9 form to complete a 1099-MISC form to file with the tax authorities by the end of the financial year. This form outlines all the payments made by the company to you as a contractor/freelancer.

Financial institutions sometimes also require you to report capital gains, dividends, interest earned. Hence, as a part of the onboarding procedure, most companies or financial intuitions will send out a W-9 form when you are employed. If you aren’t sent one, you can download a W-9 form straight from the IRS website.

How to Fill Out W-9 for Individuals?

Okay, here we get to the crucial part: how to fill out W-9 for Individuals? Filling out the form is pretty straightforward; however, you have to be careful as it’s easy to mess up.

The six-paged form is pretty short if you exclude all the instructions. Your employer will partially fill out the form, leaving only half of it for you to fill.

Your employer fills out their registered name and your designated Employee Identification Number (EIN), and the rest is all yours.

Download the W-9 form (PDF)

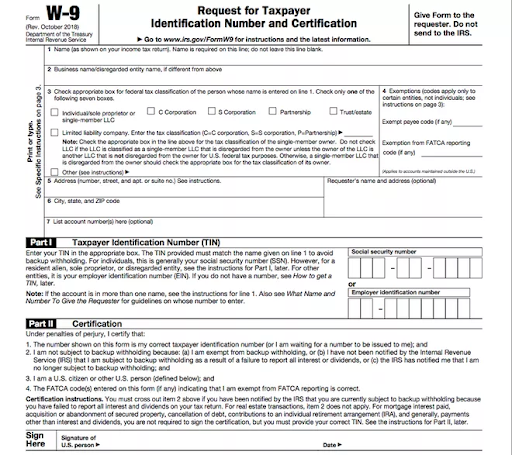

Below is a breakdown of all the crucial sections of the W-9 form that you, as an independent contractor/freelance, must fill:

Name

Write down your full name matching your official documents, preferably in block letters.

Business name

You can use this field if you have a business name, disregarded entity name, or a DBA; you can also leave this blank if you wish to do so.

Federal tax classification

Here, you can see seven different categories.

For example, you can check the first box if you are an individual or a sole proprietor of a limited liability company (LLC).

A sole owner business works under the proprietor’s social security number and won’t come under any other type of business. Therefore, taxes too apply to single-member LLCs in the same format.

Next would be the C-corporation, S-corporation, Partnership, and Trust/estate businesses.

You can check these boxes if you belong to any corporations, partnerships, or trustees professionally.

Finally, we get to the Limited Liability Company box. This box is meant only for those part of Partnerships or LLC businesses with multiple members.

Exemptions

Unless you are part of a business or an entity tax exemptions, you won’t need to fill this field.

However, if you are a part of a business or entity, you’ll need to provide a designated code that offers the authentication.

Most businesses are exempt from backup withholding and will fill out a code.

However, in a rare case where your employer is not, they will have to deduct a flat 24% off as income tax from your paycheck.

If you are an individual who has an account outside the USA, you may be exempted under the Foreign Account Tax Compliance Act (FACTA); refer to page 3 of the form to check if you qualify; else, leave it blank.

Address, city, state, and ZIP code

You can utilize this field to fill up your current address. Ensure that you fill-up the same address where your employer mails you for communication.

Account number(s)

You can choose to share an account number; it is optional.

Taxpayer identification number (TIN)

Here you have two options; you can identify yourself with your state-issued social security number (SSN) or TIN. If you are a resident alien, you can also use your Individual Taxpayer Identification Number (ITIN) issued by the IRS.

Certification

Okay, now we get to the final step of the process.

Here, you sign and date the form verifying that the information provided is authentic and consensual. Then, ensure that you go through all the fields once again for the final time and sign the document.

Summing Up

Whether you are a contract worker, freelancer, or even self-employed, a W-9 form is vital for staying tax-compliant with the IRS. The W-9 serves you as an agreement to allow you the freedom to do your taxes.

Unlike a W-4 or 1099, you don’t need to send the W-9 form to the IRS; rather, you send it to your employer. Ensure you double-check all the details before signing and sending it.

And finally, always make sure you send it through secure channels and to certified professionals to prevent any misuse of your data.

While you are here, check out our article on bookkeeping secrets here.

How AOTAX Can Help you Get Through the Tax Season

At AOTAX, we strive to make tax-filing hassle-free. Here’re some ways we can make filing your tax a breeze:

- If you are someone who requires support staying organized, you may benefit from AOTAX’s seamless 100% Online Process.

- Our financial advisors are available 24*7 to provide you with high-quality services.

- Better yet, you can get a free tax draft within 24 hrs before choosing to file with us.

- If you are a freelancer or a contract worker and get paid more than $600 a year, ensure that you get 1099 before the 31 of January to avoid issues.

- If you have a tough time tracking all your taxes, you can also opt for a tax filing software like TurboTax to keep up.

With that, we conclude this article on W-9s and how to fill out W-9s for individuals. We hope that this article clarifies what W-9 is, how it functions, and helps you fill up your W-9 in the future.

Recent Comments