How can a qualified tax professional help you e-file your taxes amidst the pandemic to maximize your refunds?

How can a qualified tax professional help you e-file your taxes amidst the pandemic to maximize your refunds?

By hiring qualified tax professionals for your tax preparation, you are free from the stress of preparing the tax returns alone. The expertise of qualified professionals would ensure that you obtain all the deductions and credits which you are eligible to receive. You can gain peace of mind, avoid making mistakes while filing tax returns, and also save your time by hiring qualified tax professionals.

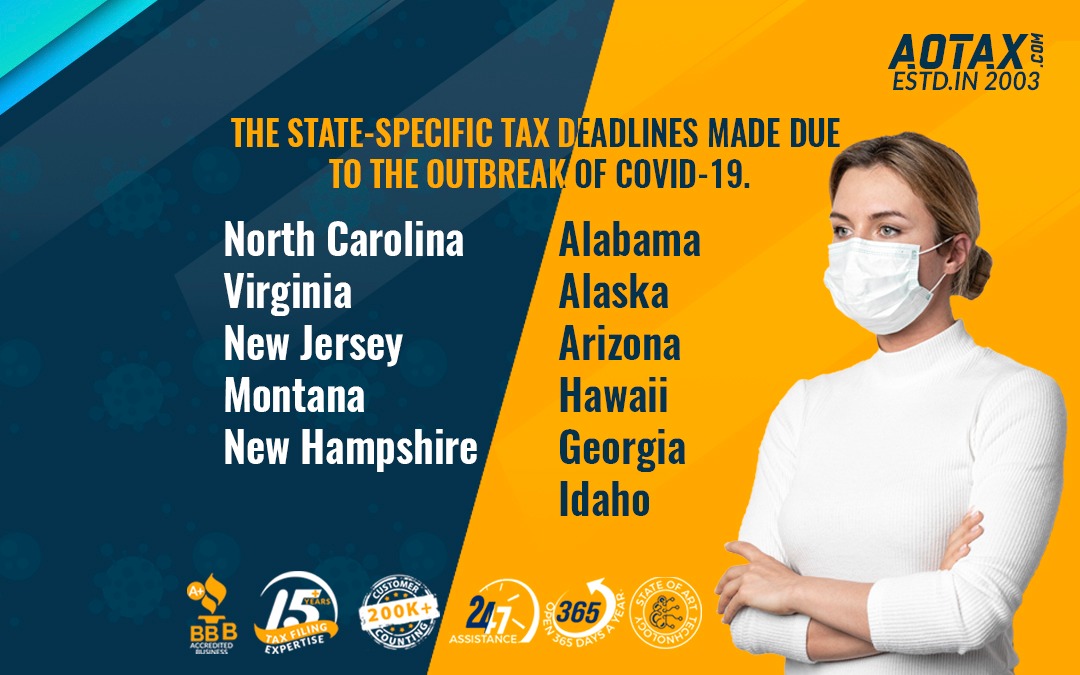

Currently, the pandemic COVID-19 has created mayhem all around and has affected the economic condition of the entire country. Several businesses have been shut down and millions of Americans have lost their sources of livelihood. In such a deteriorating situation, obtaining a considerable amount of tax refund would be very helpful to ease the financial stress for some time.

If you are preparing your tax returns with the help of a qualified tax professional, your tax preparer would suggest you several methods to e-file by which you can obtain maximum tax refunds.

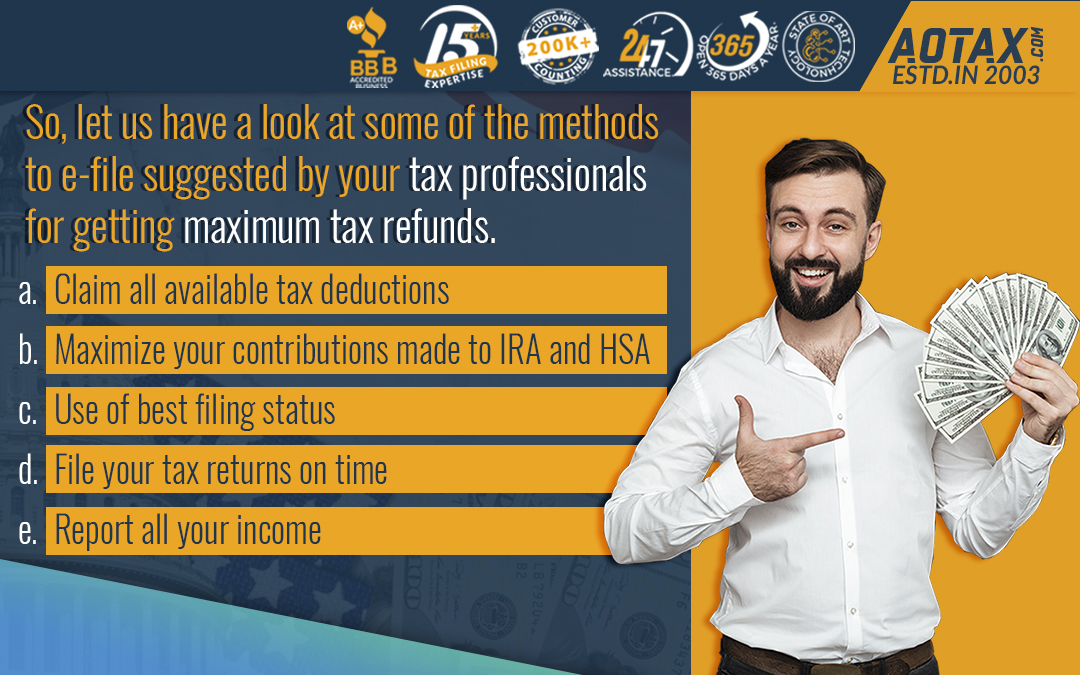

So, let us have a look at some of the methods to e-file suggested by your tax professionals for getting maximum tax refunds.

a.Claim all available tax deductions

Your tax preparer would suggest you to dig into all available tax deductions. There are many common deductions available such as charitable donations, medical costs, interest on mortgage and education expenses, etc. The deductions would be subtracted from your AGI (Adjusted Gross Income) thus, lowering your taxable income. As your taxable income would be low, you would have to pay fewer taxes and you can obtain higher refunds.

However, there are some deductions which you might not be aware of or are very easily overlooked such as State Sales Tax, Student loan interest, Out-of-the pocket charitable contributions, Certain jury duty fees, Child and dependent care, Reinvested dividends, State income tax paid on returns of last year, Earned Income Tax Credit (EITC), etc. You must keep good records of your deductions especially in case of charitable contributions. Moreover, your tax preparer would suggest you to ensure that you are claiming deductions for those organizations which have the status of “Tax-exempt” with the IRS.

b.Maximize your contributions made to IRA and HSA

Your tax preparer would suggest you maximize your contributions which you are making towards the IRA and the HSA. Traditional IRA contributions can help reduce your taxable income. The contributions made towards Roth IRA do not qualify for tax deductions but they can qualify for Saver’s credit if you can meet the income guidelines. In case, you are self-employed you can be able to contribute towards a certain self-employed retirement plan till 15th October 2020.

Your pre-tax contributions to an HSA can also help lower your taxable income. Your tax preparer would suggest you to contribute more towards your HSA before the timelines are closed. You should have enrolled in a health insurance plan which has high deductibles that either meet or exceed the required amounts of the IRS.

c.Use of best filing status

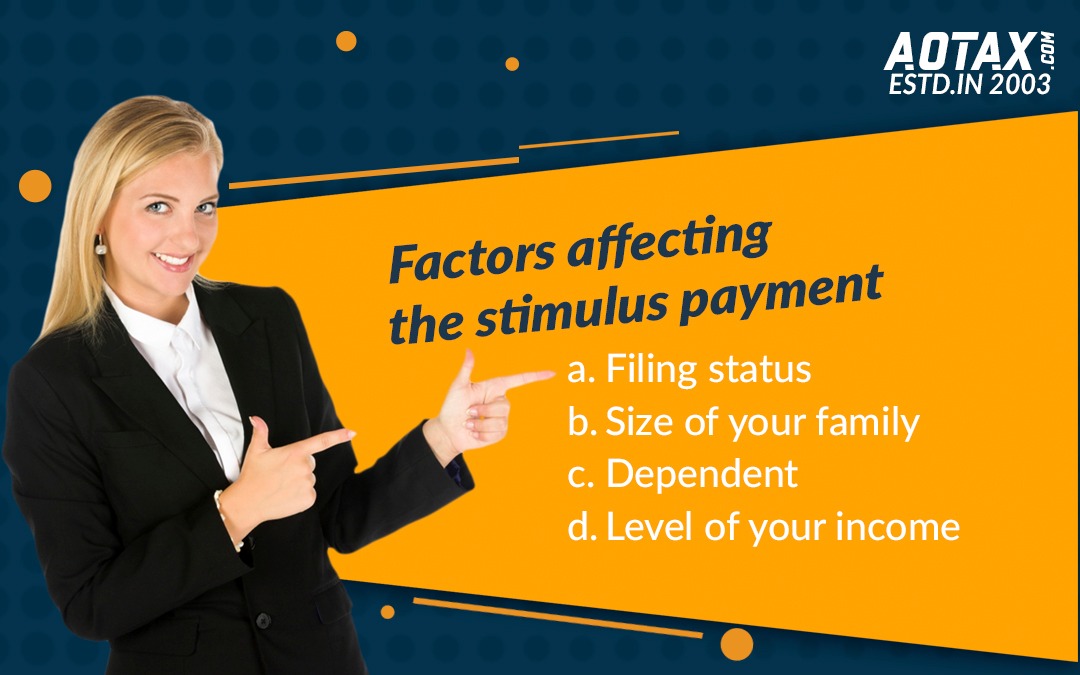

One of the major factors which can maximize your tax refunds is the choice of your filing status. You must inform your tax preparer about any of your major life changes before e-filing. Your relationship status on 31st December of a year determines your entire year’s filing status and you must use it while filing your tax returns. These options for filing status include Single, Married and filing jointly, Married and filing separately, Head of household or qualifying widower. If you could file your tax returns using two statuses such as “Single” and “Head of Household”, your tax preparer can calculate your taxes and find out which one would be beneficial for you in terms of more returns.

d.File your tax returns on time

Your tax professional would always suggest you to file your tax returns on time. This increases your chances of getting a maximum refund. The only exception to this is the case in which you have filed for an extension in the timeline to file your tax returns. The IRS charges penalties for not being able to file your income tax returns on time. Your penalty would be around 5% of your unpaid taxes for each month late up to 5 months from your tax filing deadline. Moreover, if you are not paying your taxes on time the IRS would charge penalties and interest on it. If there are penalties and interest levied by the IRS, then it is quite obvious for you to obtain low tax returns.

e.Report all your income

Many people do not report all income on their return. This can be intentional or unintentional but the IRS would charge penalties for this. If IRS uncovers your unreported income then it would charge penalties and interest on your unpaid taxes. Your tax professionals would suggest you to spend some extra time in reviewing your returns and make sure that you are not forgetting any source of income. Usually, the sources of income that are overlooked are the interest income, income from dividends, contract work, 529 contributions, charitable gifts, etc. You can maintain a spreadsheet and keep on updating your income sources every year to avoid mistakes while tax preparation.

Conclusion

Hence, with the help of these tips and methods, you are sure to maximize your refunds during these difficult times. If there is an error after filing your tax returns which would affect your refund amount, you can amend your return by filing Form 1040X.

Recent Comments