State and Local Tax relief laws for COVID-19

State and Local Tax relief laws for COVID-19

The novel coronavirus (COVID-19) is spreading rapidly with a huge toll on the lives of common people and the global economy as well. In the US, the number of people being affected by the COVID-19 is on an increase and has reached around 4 lakhs now. The number of people who have died due to COVID-19 in the US is approximately around 11,000. Similarly, many people have even lost their livelihoods due to the closing or the downfall of several businesses.

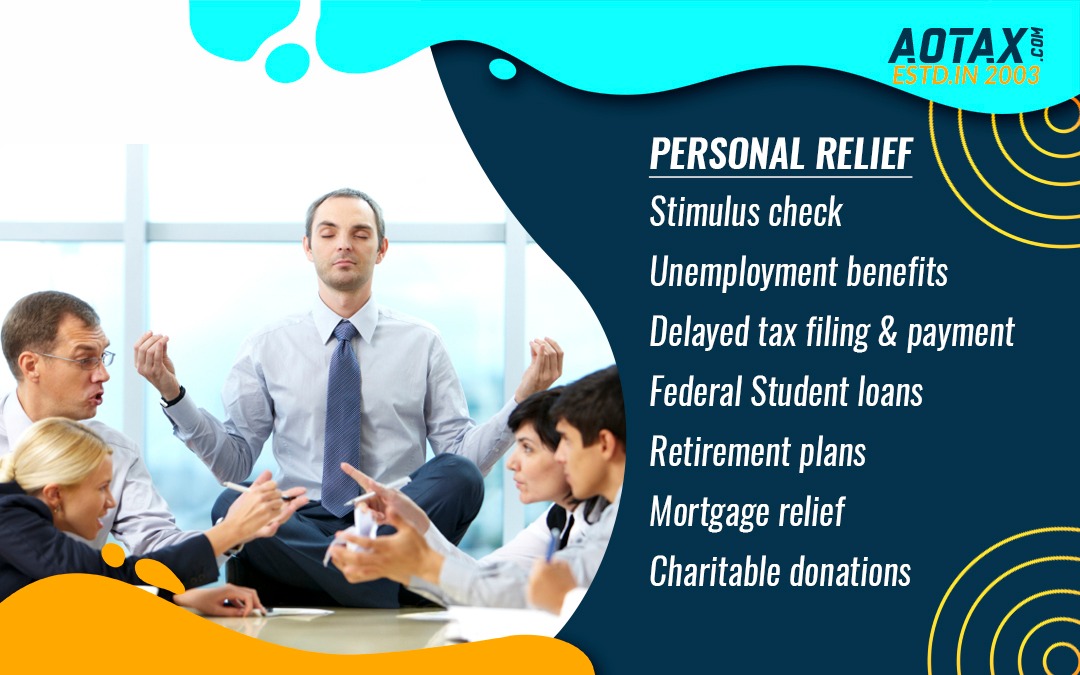

However, Tax relief laws the Federal Government has been extremely considerate towards the sufferings of the common people and has taken several initiatives for providing some relief to them. The income tax payment and return filing deadline for the taxes due on 15th April 2020 has been postponed to 15th July 2020 by the IRS. Also, several new laws have been implemented by the Federal Government for the support of individuals, small and medium scale businesses even. The Coronavirus Aid, Relief and Economic Security Act (CARES), Families First Coronavirus Response Act, Stimulus Package, etc. are some of the major initiatives taken by the Government for providing support and assistance to people.

Tax relief laws by State Government

In the US, the tax rules and laws associated with the Federal Government and the State Government are different from each other. In this distressful period, the State Government of different states of the country has announced various changes and new rules related to the tax laws.

Let us talk about some of the major tax relief laws imposed by the State Government in the different states to deal with the economic disruption caused by COVID-19.

Alabama

- In Alabama, the Revenue Department has announced on provisions for tax relief to small businesses that would not be able to pay their Sales tax for February, March, and April. Those small retail businesses whose monthly sales in the previous year have been $62500 or less on average can have the liberty to file their sales tax return for February, March, and April without paying the State Sales tax. There will be a waiver of late tax payment penalties for these small retail businesses through 1st June 2020.

- The deadline for motor vehicle registration and vehicle property tax payment for March 2020 has been extended through 15th April 2020. Moreover, tax relief would be available for State lodgings tax account holders who are unable to make their payment for February-April 2020.

- The due date for payment and filing returns for 2019 Income tax and 2020 estimated Income tax which were due on 15th April 2020 has been extended to 15th July 2020.

California

- The Income Tax deadline for return filing, payment for 2019 and 2020 estimated tax payments Quarter 1 and Quarter 2 has been extended to 15th July 2020. This is also applicable for 2020 LLC taxes, fees, and 2020 non-wage withholding payments.

- The Californian Employment Development Department (EDD) has declared that the employers in the State who have been impacted by COVID-19 can request a delay of up to 60 days in filing their State payroll reports or in the deposit of their payroll taxes without the payment of any penalty. The employers must provide a written request for this extension within 60 days of the original tax filing/payment due date.

- Moreover, there has been an announcement on the deferral of business taxes for supporting small businesses that have been affected by the COVIS-19.

Connecticut

- The Department of Revenue Services in Connecticut has extended the deadlines for filing the annual tax returns due on or after 15th March 2020 and before 1st June 2020 to 15th June 2020.

- Also, the tax payments which are associated with these tax returns have been extended to the due date available in June.

- The personal income tax return filing deadline has been extended to 15th July 2020 and this extension is also applicable for estimated tax payments of 2020 Quarter 1 and Quarter 2.

Columbia

- For income tax returns, the deadline for tax payment and return filing which was due on 15th April 2020 has been extended to 15th July 2020.

- In the District of Columbia, penalties/interest will be waived for the failure of sales tax payment for a period that ends on 29th February 2020 or 31st March 2020 if all the taxes are paid completely on or before 20th July 2020. This waiver does not apply to hotels or motels which can defer property tax under another emergency legislation.

- This legislation states that hotels/motels can avail penalties waiver for the delay in payment of the property tax’s first installment of 2020 if the installment is paid by 20th June 2020.

Texas

- In Texas, the Comptroller has declared that the sales tax collected in March 2020 would be remitted and would be available for emergency health care and other emergency operations for the people.

- The Texan Comptroller has also insisted on the businesses in the State to make use of short term payment agreements for meeting the deadline of March 2020.

Massachusetts

- The Department of Revenue in Massachusetts has implemented an emergency regulation amendment. According to this amendment, the sales and use tax return filing and payment which are due for the period of 20th March 2020 to 31st May 2020 will remain suspended. These tax return filing and tax payments would be now due for 20th June 2020.

- Marijuana retailers, marketplace facilitators or motorcycle vendors are not included within this amendment. Any penalties or interest would be waived but the accumulation of statutory interest will continue.

Virginia

- In Virginia, the Department of Taxation has announced that all the income tax payments which are due from 1st April 2020 to 1st June 2020 can be paid at the Department anytime on or before 1st June 2020. If all the payments are received by 1st June 2020, then the Department would waive all penalties for late payment otherwise penalties would start accumulating from the original payment due date.

- However, interest would also keep accruing from the original due date of payment. Some of the taxes which are eligible for this extension and waiver are individual, fiduciary and corporate income taxes and any estimated income tax payments in this period. The State provides an automatic filing deadline extension for all the taxpayers for six months. Also, the Department of Taxation would consider requests for sales tax dealers who would request an extension in the sales tax payment and return filing which was due on 20th March 2020 and would extend it till 20th April 2020.

Montana

- The Montana Revenue Department would assess the situation of taxpayers on a case-by-case basis and might permit the deferral of tax payments for up to one month at an instance.

- The taxpayers must contact the Tax Collection Bureau by email, phone or mail at least one week before the actual due date of payment for making a deferral request.

- The 2020 estimated tax payments for the first quarter have been extended to 15th July 2020 and the second quarter payment is also due on 15th July 2020.

Conclusion

Hence, along with the Federal Government, these are some of the tax relief laws/rules implemented by the different states. Taxpayers can communicate with their respective State tax agencies for complete details on the amendments made in their respective tax laws for COVID-19. These rules and amendments in State tax laws would act as a support for the distressed individual taxpayers or businesses in coping up with the economic disruptions.

References

https://tax.thomsonreuters.com/news/tax-relief-offered-by-states-and-localities-in-response-to-covid-19/?utm_campaign=T_CPE_NSL_9017597_covid19news_20200406_PR_EM1&utm_medium=email&utm_source=Eloqua&site_id=82769734&cid=9017596&chl=em&sfdccampaignid=7014Q000002SW4xQAG&elqTrackId=8432E59EA486AE4E4F693C86C8DF092E&elq=1fca5b09cc9e4a48adaa952eec158059&elqaid=22686&elqat=1&elqCampaignId=16486

Recent Comments